Introduction

In the complex world of business, establishing trust and credibility is paramount. One of the most effective ways to enhance your reputation and ensure compliance in various industries is by partnering with a reliable bonding company. This article delves deep into the myriad benefits that come from such partnerships, providing insights into how they can positively impact your business operations.

The Benefits of Partnering with a Reliable Bonding Company

Partnering with a reliable bonding company offers multiple advantages that are crucial for businesses across different sectors. From enhancing credibility to ensuring compliance with legal requirements, bonding companies play a vital role in the success and sustainability of various enterprises.

Understanding the Role of a Bonding Company

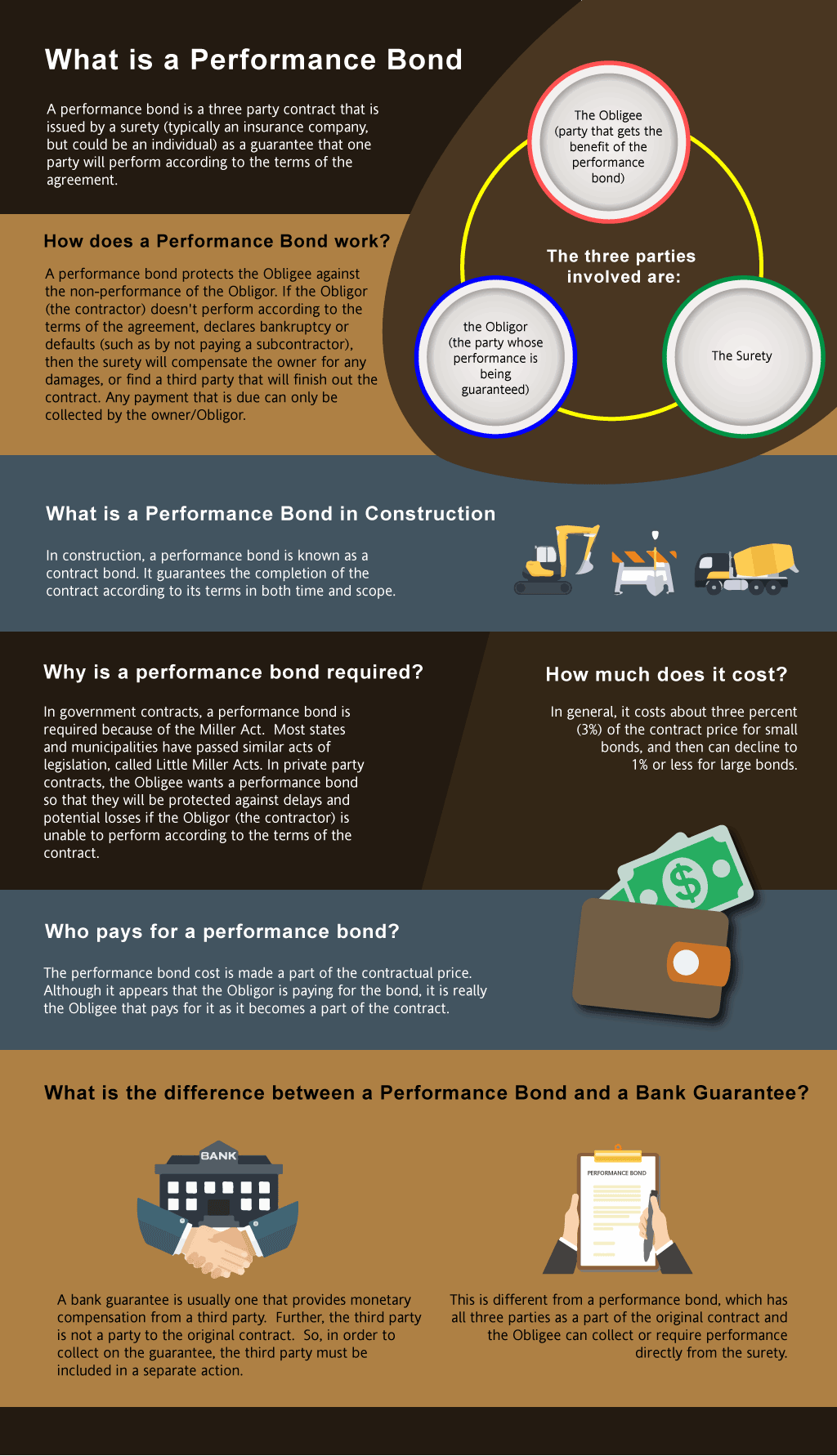

A bonding company provides surety bonds, which are legally binding contracts that guarantee the performance of a contractor or an entity. In essence, these bonds protect clients from how to get license and permit bonds potential financial loss due to failure in contract execution.

Enhanced Credibility and Trustworthiness

One primary benefit of engaging with a reputable bonding company is enhanced credibility. Having a surety bond signals to clients and partners that your business meets specific standards and has been vetted for reliability.

Building Client Confidence

Clients are more likely to engage with businesses that possess surety bonds as it provides them peace of mind knowing their projects are protected. This trust can result in increased business opportunities and long-term relationships.

Competitive Advantage in Bidding Processes

In many industries, especially construction, being bonded is often a prerequisite for bidding on projects. Having a reliable bonding company allows you to participate in more bids, thus increasing your chances of securing contracts.

Financial Protection Against Losses

When you partner with a bonding company, you’re essentially safeguarding yourself against various financial risks associated with contract execution.

Mitigating Financial Risks

If a contractor fails to fulfill their obligations, the client can claim against the bond rather than facing direct financial losses. This protection is invaluable for maintaining cash flow and project viability.

Insurance Against Non-Performance

Non-performance or poor performance can lead to costly delays and penalties. A surety bond ensures that clients have recourse if issues arise, providing another layer of financial safety.

Compliance with Legal Requirements

Many states require certain businesses to be bonded before they can legally operate or obtain licenses. Partnering with a bonding company ensures compliance with these regulations.

Navigating Complex Regulations

Bonding companies understand the legal landscape surrounding different industries. They can provide guidance on what types of bonds are necessary and assist in navigating the complexities involved in obtaining them.

Avoiding Penalties and Legal Issues

Failing to secure required bonds can lead to significant penalties or even legal action against your business. By partnering with a reliable bonding company, you minimize these risks effectively.

Improved Project Management Efficiency

Utilizing the services of a bonding company can license and permit bonds streamline project management processes significantly.

Clear Expectations Set from the Start

With bonded contracts, all parties involved have clear expectations regarding performance and completion timelines. This clarity enhances communication among stakeholders.

Reduced Disputes Over Contract Terms

Since bonds outline specific obligations, there’s less room for ambiguity—thus reducing disputes over contract terms that could delay project completion or escalate costs.

Access to Financial Resources and Support

Bonding companies often have connections within the financial sector that can be beneficial for your business.

Facilitated Access to Capital

A strong partnership may facilitate access to loans or other financial resources needed for project completion or expansion without burdening your existing capital reserves.

Expertise in Financial Planning

Many bonding companies offer consulting services that help businesses develop sound financial strategies tailored specifically for their industry needs.

Strengthening Business Relationships through Reliability

Reliability is one hallmark trait every successful business should strive for; partnering with a dependable bonding company fosters this quality further.

Long-Term Partnerships Built on Trust

When clients see consistent performance backed by surety bonds, they become more inclined to form long-term partnerships based on mutual trust and understanding.

Encouraging Referrals through Satisfied Clients

Satisfied clients are more likely to refer your services within their network when they feel confident about your capabilities—an invaluable marketing tool built through reliability established via bonding partnerships.

The Benefits of Partnering with a Reliable Bonding Company for Small Businesses

Small businesses stand to gain immensely from partnering with reliable bonding companies due largely to resource limitations compared larger competitors face:

Cost-Effective Solutions Tailored for Smaller Enterprises

Reliable bonding firms often offer flexible packages designed specifically around smaller budgets without compromising quality assurance & support levels

Access To Market Opportunities Otherwise Out Of Reach

By having necessary guarantees through Surety Bonds small enterprises tap into lucrative markets previously unavailable due stringent qualification criteria imposed by certain clients or regulatory bodies

How To Choose The Right Bonding Company?

Selecting an ideal partner requires careful consideration as not all firms provide uniform offerings:

Evaluate Industry Experience Review Client Testimonials Compare Pricing Structures Assess Customer Service Quality Confirm Licensing & Accreditation Status Seek Recommendations from Trusted Peers Check Their Claims Handling Process Efficiency Understand Their Financial Stability Levels Before Signing Contracts **Request Detailed Information About Their Services Offered Including Any Niche Specialties Available Within Given Markets They Serve And What Types Of Bonds They Offer Specifically Based On Your Needs! ** 10 . Consider Their Responsiveness And Communication Style Throughout Your Interactions With Them As Well!Frequently Asked Questions (FAQs)

What exactly is a surety bond?- A surety bond is an agreement among three parties: the principal (the party required to obtain the bond), the obligee (the party requiring it), and the surety (the bonding company) ensuring obligations are fulfilled.

- Most industries have regulations regarding licensing that may require you to obtain specific types of bonds before operating legally.

3 . Can my business be unbonded? – Yes; however it limits opportunities available since many potential clients will only work alongside bonded organizations indicating reliability & professionalism.

4 . What should I look out for when choosing my first partner? – Always check reviews/testimonials regarding previous clients’ experiences plus ensure they cater directly towards niche needs relevant within respective industries too!

5 . Are there any hidden fees associated when working alongside these firms? – Transparency should exist throughout all agreements made; inquire upfront concerning any additional charges prior signing off documents!

6 . Does every bond type serve similar purposes? – No! Each kind varies based upon specific objectives/goals desired so research carefully beforehand selecting what aligns best according chosen paths forward!

Conclusion

Partnering with a reliable bonding company brings forth numerous benefits essential for any business aiming at growth while maintaining compliance & trustworthiness within competitive marketplaces today! From financial protections provided ensuring smooth operational continuity right down access critical resources helping navigate tricky landscapes—fostering strong relationships built around reliability truly defines success moving forward! So take proactive steps now towards solidifying those partnerships ensuring brighter futures lie ahead!

By understanding "The Benefits of Partnering with a Reliable Bonding Company," you're not just investing in security but also paving pathways toward sustained growth & stability—an investment worth making indeed!